Most Americans will be happy to have 2020 behind them as a tumultuous election and a simultaneous pandemic resulted in an uncertain and worrisome period fraught with dire economic predictions, worst-case health scenarios, and extreme stock market gyrations.

The price of oil technically went negative at one point, and the Dow Jones Industrial Average dropped a quick 8,000 points only to recover later in the year. The federal government’s response to the pandemic-induced economic woes was a huge stimulus package that gave cash payments to most citizens. The Payroll Protection Program–that was in effect a forgivable loan—was offered to and accepted by many businesses, both small and large. And as of this writing, a pair of rapidly developed and engineered vaccines have become available that could actually end the COVID-19 scourge.

So, what happened to one- and two-bedroom apartment rents? Nationally, on average, they went up. While some large metro areas in New York and California saw steady median rent declines, other areas trudged upward and pushed the overall national trend into positive territory.

Generally, a strong economy, strong apartment demand, and rising inflation all translate into median national apartment rent gains. In 2020, although it is recovering, the economy took a huge hit. We are still seeing strong demand, but the inflation picture is muddled as energy prices—also recovering as of late—fell early in the year and blunted inflation figures. 2020’s circumstances are unique and, in many cases, generally trusted statistical drivers have been overridden by fast-moving events.

Our stats tell the story, however, and in an effort to give renters (and potential renters) market information in close to real-time, Rentable releases monthly reports on rental trends throughout the year. This Annual Rent Report is a more drilled-down look at the year in renting. We will answer the following questions:

- How did rent prices change nationally? At the state level?

- Where did rent increase the most during 2020, and where did it decline?

- Where are the 10 most expensive rental markets?

Let’s get into it!

Median Rent Nationwide

Nationally, 2020 one-bedroom median rents moved higher each month with slowed movement in February, March and April followed by accelerated increases toward the end of the year. By December, one-bedroom rents had increased by a modest 3.04 percent.

Two-bedroom units had a bumpier ride as the index went negative in June and July and finished the year with close to flat 1.71 percent rise.

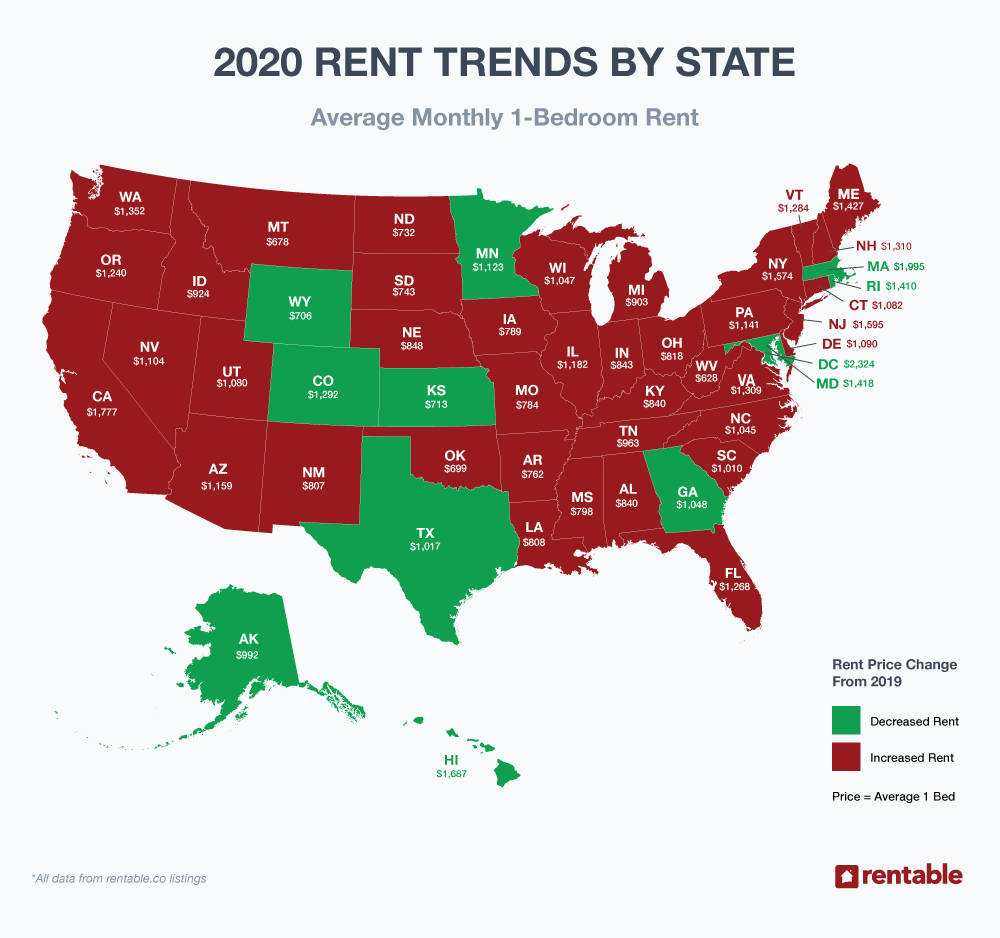

US Average Rent: Rent Report by State

Average rent increased in 39 states–and decreased in only 12, including the District of Columbia.

The biggest loser was the District of Columbia with a loss of 1.45 percent followed by Alaska where median rents fell 0.83 percent.

The highest rent hikes were seen in Vermont—3.07 percent—and Louisiana, as that state reported a modest 2.63 percent increase.

Only four states posted fluctuations of more than two percent, and all of those were gainers.

2020’s highest one-bedroom rents were seen in the District of Columbia at $2,324, Massachusetts at $1,995, California at $1,777.

More affordable rents like the following could be found across the nation:

- West Virginia: $628

- Montana: $678

- Oklahoma: $699

2020’s Greatest Monthly Rent Changes

Looking at statewide and national rental data gives us a good idea of what trends renters around the country are seeing. But when we take a closer look city-by-city and by apartment type, a more diverse set of trends emerge. The following stats track the top ten average monthly rent changes—a measure of volatility.

1-Bedroom Apartment Gainers

Fort Lauderdale, FL topped our one-bedroom gainers list with a monthly average increase of 2.96 percent. New Haven, CT and Fresno, CA reported almost identical gains of 2.88 and 2.87 percent respectively. Norfolk VA followed with a 2.64 percent jump to $1,175 while Birmingham, AL rose 2.53 percent.

The bottom five on our gainers list, Syracuse, NY, Rochester, NY, Cincinnati, OH, Colorado Springs, CO and Jacksonville, FL are were in a tightly packed range, each moving upward between 1.71 and 2.19 percent monthly.

Fort Lauderdale proved to be the most expensive place to live on our list at $1,590 while Syracuse, NY was the most affordable at $844.

1-Bedroom Apartment Losers

San Francisco showed the most volatility as it moved downward by a monthly average of 2.70 percent. College Station, TX followed with a loss of 1.93 percent. Next, Berkeley, CA fell by an average of 1.93 percent per month.

Washington, DC, Honolulu, HI and Salt Lake City, UT all dropped between 1.32 and 1.45 percent.

New York City, NY, Oakland CA, San Jose Ca and Scottsdale, AZ averaged monthly negative moves of 1.16, 1.10, 1.10 and 1.03 percent respectively.

San Francisco was the priciest locale on our monthly average decreasers list at $3,452 while College Station, TX was by far the cheapest at $813.

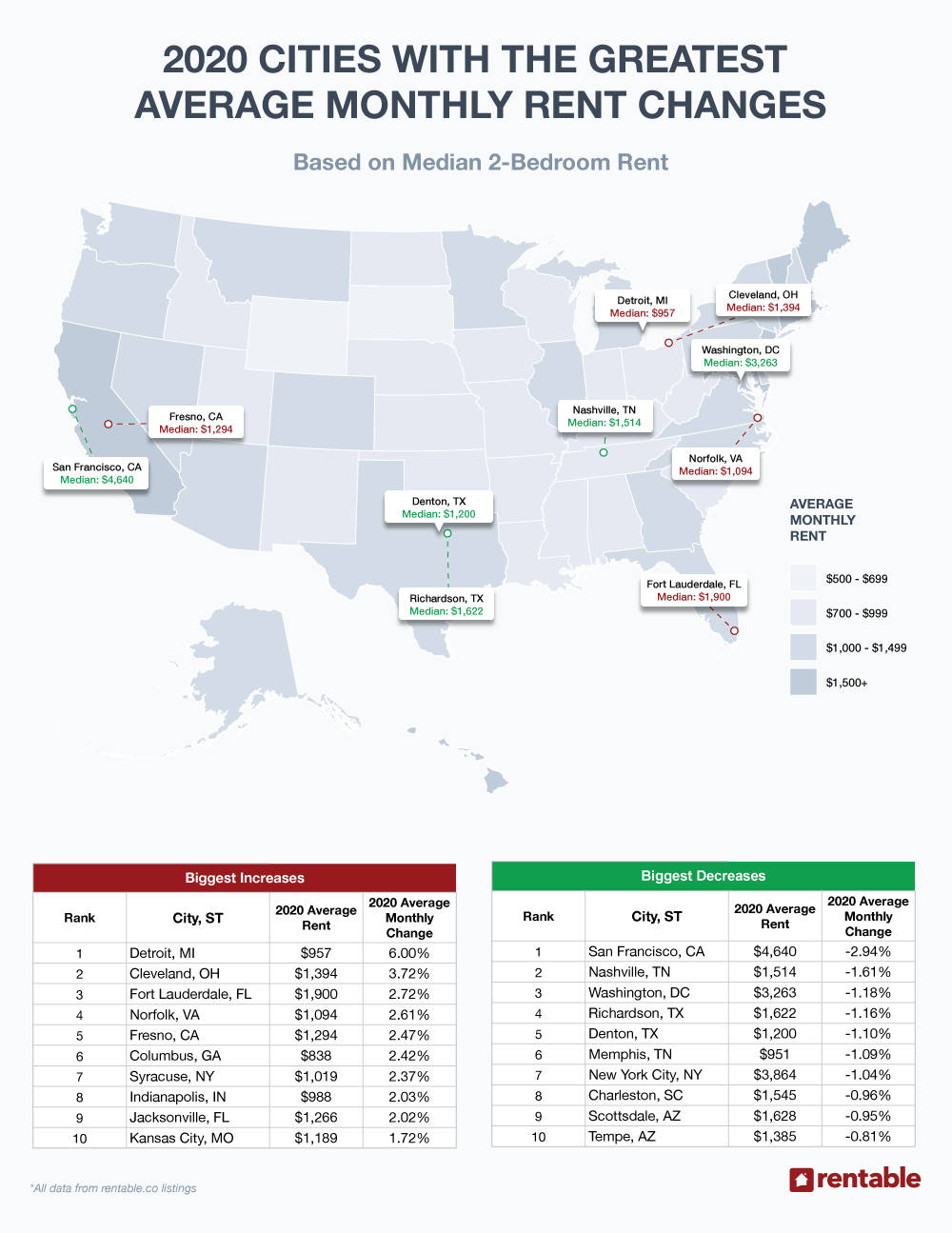

2-Bedroom Apartment Gainers

Detroit, MI was the 2020 average monthly change leader with a hefty 6.00 percent increase to $957. Cleveland Ohio was a distant second with a 3.72 percent gain followed by Fort Lauderdale, FL reporting an increase of 2.72 percent. Norfolk, VA was relatively strong rising 2.61 percent to $1,094, Fresno CA, Columbus, GA, Syracuse, NY, Indianapolis, IN and Jacksonville, FL managed gains of slightly over 2 percent. Finally, Kansas City, MO reported a positive 2020 average monthly rent change of 1.72 percent.

Fort Lauderdale, FL by far boasted the highest priced 2-bedroom unit on this list at $1,900. First place Detroit, MI was the most wallet-friendly–just under a thousand dollars at $957.

2-Bedroom Apartment Losers

2020 average annual two-bedroom losers showed a tighter average monthly range as San Francisco, CA fell 2.94 percent to $4,640 and Nashville, TN lost 1.61 percent. Washington, DC and Richardson, TX fell between 1.16 and 1.18 percent on an average monthly basis while Denton, TX posted a loss of 1.10 percent.

Memphis, TN and New York City, NY lost 1.09 and 1.04 percent, respectively. Lastly, Charleston, SC, Scottsdale, AZ and Tempe, AZ all posted minimal monthly average decreases of less than 1 percent with 2020 average monthly rent changes of $1,545, $1,628 and $1,385 respectively.

San Francisco was the most expensive locale on our monthly average decreasers list at $4,640 while Memphis, TN was by far the most reasonably priced at $951.

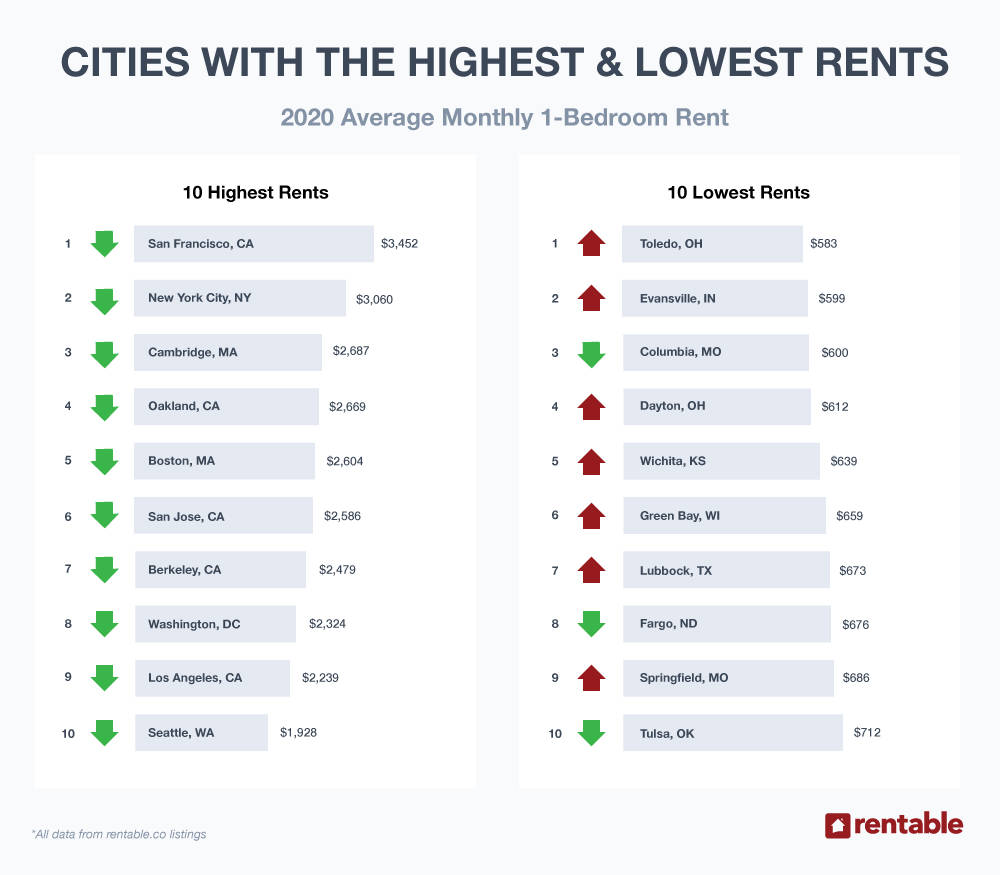

Highest & Lowest Rents in the Country

Across the country, from coast-to-coast, rent prices have continued to rise. Whether a person is renting in San Francisco, New York or Chicago, they have come to expect extremely high prices. Here’s what happened in 2020d in terms of cities with the highest and lowest rent prices.

Highest Rents

It’s no surprise that San Francisco, CA maintained its number one ranking with a pricey $3,452 average monthly 2020 rent. And it follows that New York City, NY placed second with rent at $3,062. Mirroring our 2019 report, Cambridge, MA came in third at $2,687. Oakland, CA and Boston, MA reported respective rent rates of $2,669 and $2,604. San Jose, CA was moderately expensive as it placed in sixth place at $2,586., Berkeley, CA reported a 2020 average rent of $2,479.

Washington, DC placed eighth on our highest rent list at $2,324, an average monthly decline of 1.45 percent. Los Angeles, CA posted an average monthly decline of 0.33 percent but still reported a high one-bedroom price at $2,239. Lastly, Seattle, WA fell 0.93 percent monthly and settled at a yearly average price of $1,928.

Lowest Rents

If the pricey $3,452 San Francisco rent is not an option, head to Toledo, OH for affordability because you can get a one-bedroom apartment there for less than $600 at $583. Evansville, IN is also a good choice for frugal apartment hunters at $599. Columbus, OH, at $600, was just about steady for the year with an average monthly decrease of just 0.07 percent.

Placing fourth after those top three one-bedroom lowest rent cities was Dayton, OH with a very consumer-friendly $612 monthly average 2020 rent. Wichita, KS, and Green Bay, WI reported respective rents in the mid-$600 range at $639 and $659 Lubbock, TX is a great value with an average $673 rent, and Fargo, ND—with a minimal monthly average loss of 0.48 percent—is still affordable at $676 Finally, Springfield, MO at $686 and Tulsa, OK at $716 both made our top ten average monthly lowest rent list.

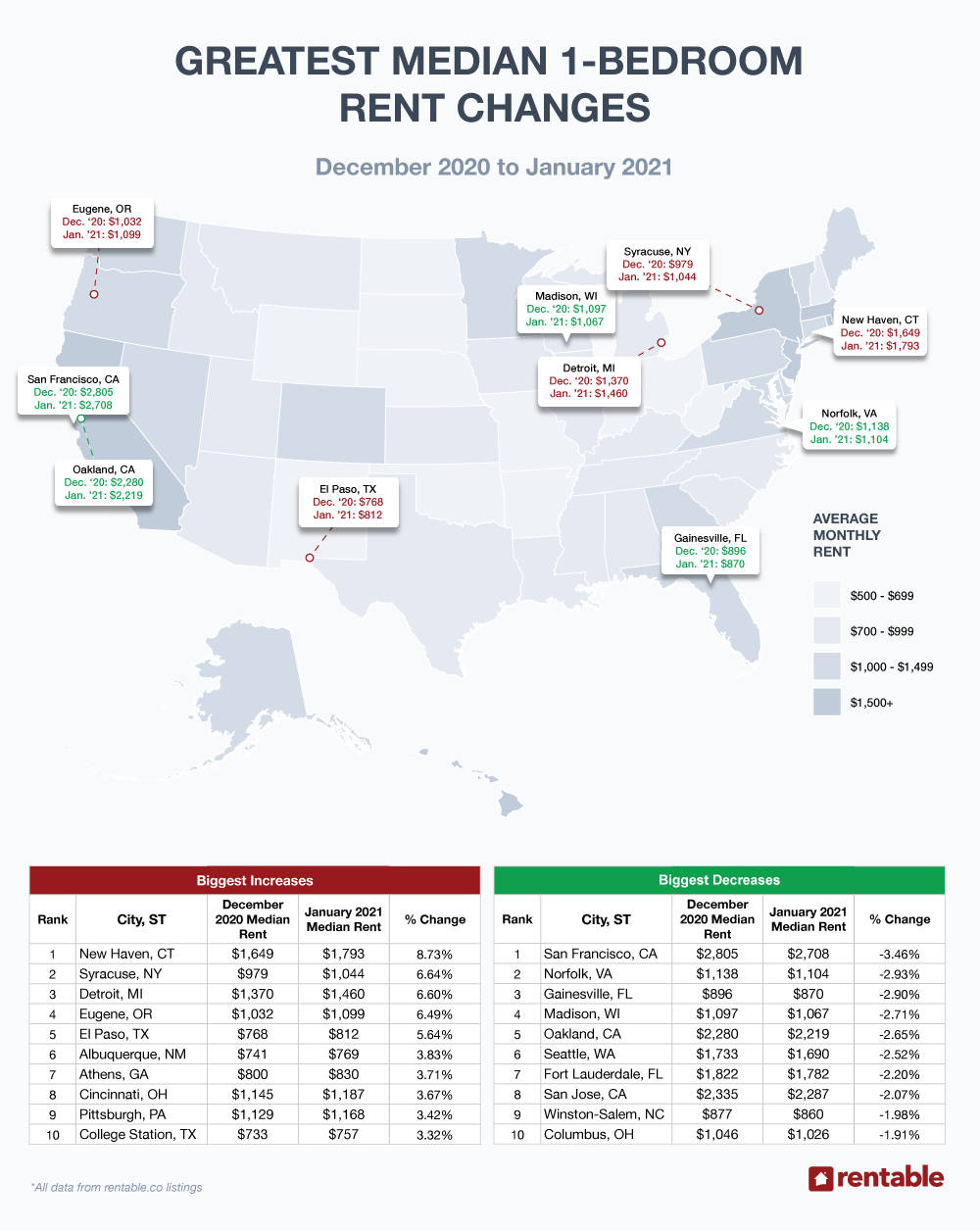

January 2020 Rent Report: Gainers More Volatile Than Losers?

In January, our top ten increasers showed a wider range than our top ten decreasers. This tells us that there is upward pressure on median monthly rent prices. Let’s look at the specifics:

1-Bedroom January Gainers

New Haven, CT rose a healthy 8.73 percent to $1793. Syracuse, NY, Detroit MI and Eugene, OR gained between 6.49 and 6.64 percent. Affordable El Paso, TX moved to a median $812—a 5.64 percent rise.

Albuquerque, NM tacked on 3.83 percent to a January median rent of $769, while Athens, GA rose $30 or 3.71 percent. Cincinnati, OH gained 3.67 percent to settle at $1,145 and Pittsburgh, PA rose to $1,168.

College Station, TX made it onto our top ten January 2021 increasers list with a bump from $733 to $757, a bump of 3.32 percent.

1-Bedroom January Losers

San Francisco, CA, continued its pandemic-driven monthly losses that began in mid-2020 as its January median one-bedroom rent fell another 3.46 percent to $2,708, an astounding drop of approximately $700 from its 2020 high.

Norfolk, VA lost 2.93 percent to $1,104 and the following cities fell 2.52 to 2.90 percent:

- Gainesville, FL

- Madison, WI

- Oakland, CA

- Seattle, WA

Of these, only Gainesville, FL reported a median rent of less than $1,000 at $870.

Fort Lauderdale, FL lost 2.20 percent to settle at $1,782 while San Jose, CA dropped to a pricey $2,287—a fall of 2.07 percent. Winston-Salem, NC and Columbus, OH both fell in the 1.91 to 1.98 percent range.

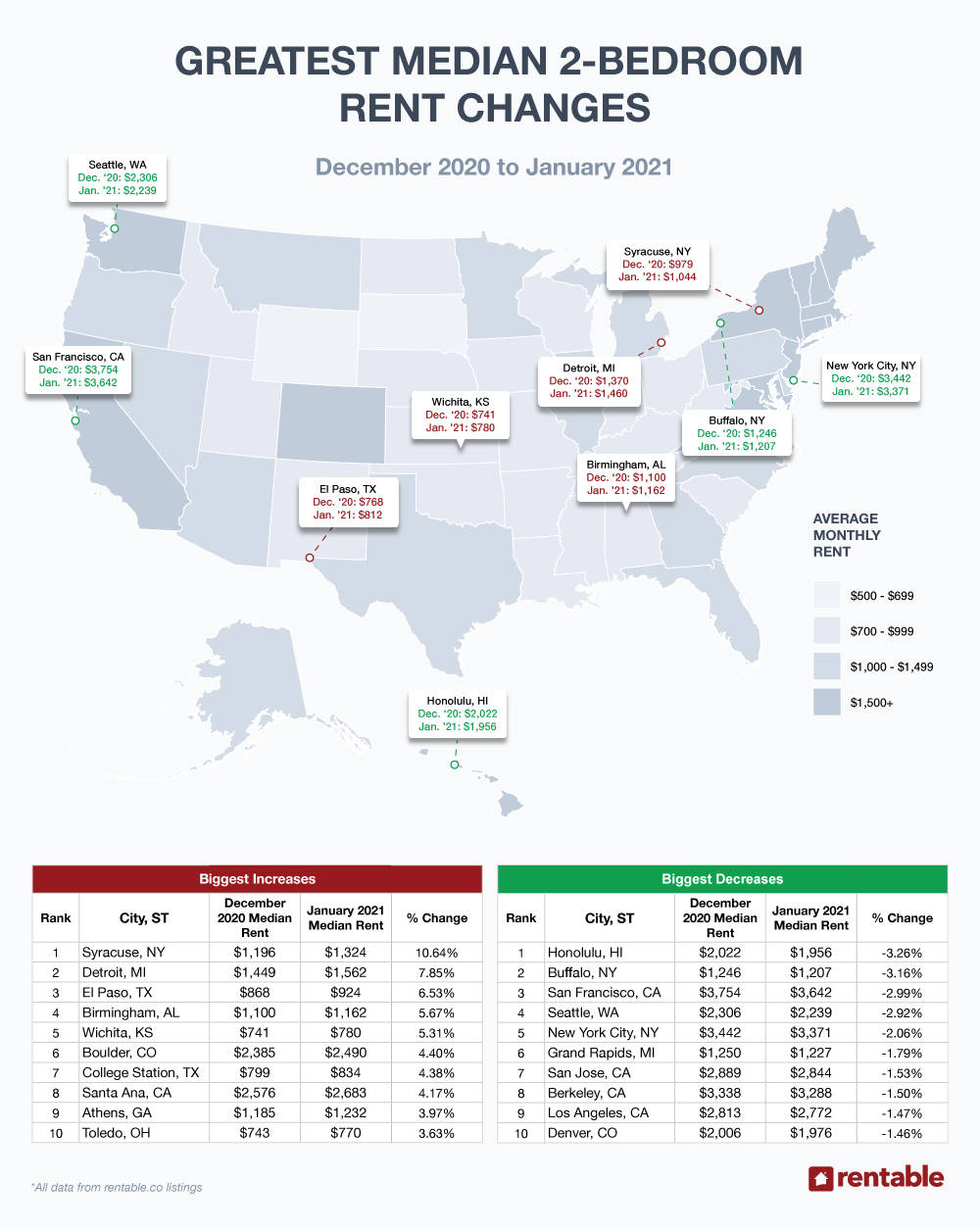

2-Bedroom January Gainers

Wintery Syracuse, NY reported a January 2021 median rent of $1,324, up a big 10.64 percent. Another cold city—Detroit, MI—rose 7.85 percent to take second place on our two-bedroom gainers list. El Paso was alone in third place with a 6.23 percent gain to $924, and Birmingham, AL reported a 5.67 percent increase to $1,162.

Also in the 5 percent arena was Wichita, KS at a median $778. Boulder, CO rose a not-insignificant 4.4 percent to an increasingly expensive $2,490. College Station, TX took seventh place with a 4.38 percent gain. And Santa Ana, Athens, GA and Toledo, OH LA all gained between 3.63 and 4.17 percent. Of those, Santa Ana was the priciest reporting a median rent of $2,683.

2-Bedroom January Losers

As we sometimes see in a rising market, losers fell less than gainers rose, and that pattern is very apparent in our January 2021 stats. Honolulu, HI fell only 3.26 percent while Buffalo, NY lost 3.16 percent at $1,207.

Chronic loser San Francisco, CA also saw its median 2-bedroom rents fall another 2.99 percent to $3,642. Seattle, WA lost 2.92 percent settling its January median rent at $2,239. New York City, NY two-bedroom median rents fell 2.06—a continuing pandemic related event.

Grand Rapids, MI dropped 1.79 percent, San Jose, CA lost 1.53 percent, Berkeley, CA fell 1.50 percent to a crazy $3,288, and both Los Angeles, CA and Denver, CO dropped approximately 1.47 percent.

February 2021 Outlook

The pandemic is still raging but the vaccines have arrived. The presidential election results are finally clear to most, and the stock market is still flirting with all-time highs. The price of oil has rebounded close to the $50 mark.

If things continue to move in this positive direction, we look for solid apartment rental increases in 2021, barring any more major disasters and calamities.

And on the home buying front things are changing quickly as well. Folks looking to downsize now might find eager buyers trying to close quickly. However, if you don’t want to part ways with your family home, but would like to have more discretionary income, a reverse mortgage could be another option to consider.

All of this impacts the rental market, so stay tuned!

For press inquiries, please contact Sam Radbil.

Methodology

Each month, using over 1 million Rentable listings across the United States, we calculate the median 1-bedroom and 2-bedroom rent price by city, state, and nation and track the month-over-month percent change. For this report, we analyzed this data for the entire year of 2020 and found the average of the monthly percent changes in list price separately for each state and city. We also calculated the 2020 average list price in each state by taking the average of all monthly average list prices.

Due to small sample sizes, we restricted our city-level analysis to cities meeting minimum population and property count thresholds.

To view Rentable’s annual reports from previous years, please follow the links below: