Despite its prevalence in both culture and legislation dating back to the late 1800s, the wage gap between men and women remains a contentious issue.

The first legislation aimed at abolishing gender-based earnings discrepancies in the private workforce was the Equal Pay Act of 1963 — 93 years after Congress passed a bill to Women’s Equal Pay Act that proposed equal pay for “comparable work” failed to pass Congress.

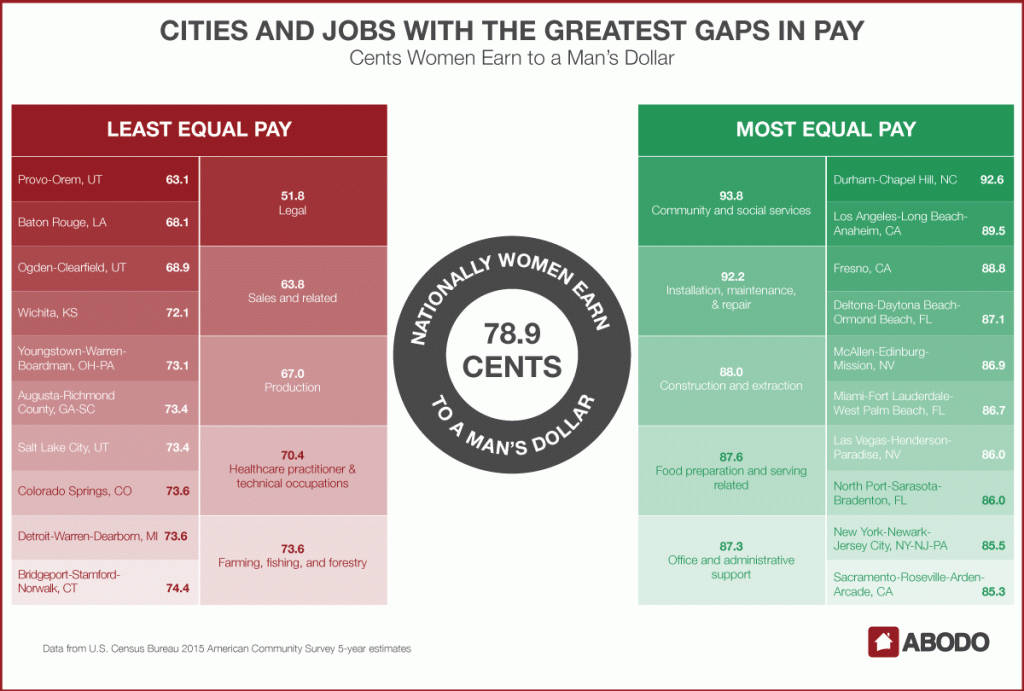

When the Equal Pay Act went into effect, requiring equal pay for equal work, women comprised 37% of the workforce and earned 59 cents for every dollar men earned. That gap has narrowed throughout the intervening decades, but has failed to disappear. Today, women earn about 79 cents for every dollar men earn. According to the American Association of University Women, the current path we’re on won’t take us to full wage parity until 2152 — that’s another 135 years.

The wage gap is a tough phenomenon to understand, with dozens of moving parts. Can it be explained away by hours worked? Or chosen profession? Does your city have an influence? In this piece, we’ll examine wage trends in metropolitan statistical areas around the country, as well as in the nation’s five fastest-growing occupations. We’ll also take a look at an area that bears a heavy share of the wage gap’s impact: housing affordability.

The National Wage Gap

Nationally, the wage gap currently sits at just over 21%. The median income for women is $39,315, which is 78.9% of the national median income for men of $49,828.

The MSA with the most equal pay is Durham-Chapel Hill, NC. Women earn 92.6% as much as men in the Research Triangle, so named for the confluence of educational institutes (North Carolina State, UNC-Chapel Hill, and Duke University) in the area. It’s the only MSA where women’s overall median salaries across industries exceed 90% of men’s salaries.

California has three MSAs in the top 10 cities for equal pay: Los Angeles-Long Beach-Anaheim (89.5%), Fresno (88.8%), and Sacramento-Roseville-Arden-Arcade (85.3%). So does Florida, with Deltona-Daytona Beach-Osmond Beach (87.1%), Miami-Fort Lauderdale-West Palm Beach (86.7%), and North Port-Sarasota-Bradenton (86%).

Utah scores particularly poorly for equal pay. Three of the 10 MSAs with the least equal pay are in the state, with Provo taking the bottom spot. Women only earn 63.1% as much as men there — and they don’t fare much better in Ogden-Clearfield (68.9%) and Salt Lake City (73.4%). Baton Rouge, LA (68.1%), is the only city outside Utah where women make less than 70% of what men make.

When it comes to occupations, one employment category has a notably large wage gap: the legal field, which encompasses lawyers, judges, paralegals, clerks, and other related occupations. Women in legal occupations only make 51.8% as much as men. Widely variable salaries — judges earn much more money than paralegals, for example — can explain some of that discrepancy, but not why more men work in the higher earning jobs. Nor can it explain why female lawyers only earn 78.2% as much as male lawyers do.

Women with jobs in sales (63.8%) and production (67%) also earn less than 70% than their male counterparts.

Nationally, women’s salaries exceed 90% of men’s salaries in two occupation categories: community and social services (93.8%), and installation, maintenance, and repair (92.2%). Construction and extraction (88%), food preparation and serving (87.6%), and office and administrative support (87.3%) also exhibit relatively low discrepancies in pay.

To get a better idea of how the wage gap plays out within industries and specific cities, we examined salaries for men and women in the five fastest-growing industries in the country, according to the U.S. Bureau of Labor Statistics. We identified the cities in each field where the wage gap was largest and smallest. And to show how that gap affects everyday life, we calculated how many square feet men and women could afford to rent in those cities, if they only spent 30% of their income on rent as the U.S. Department of Housing and Urban Development advises.

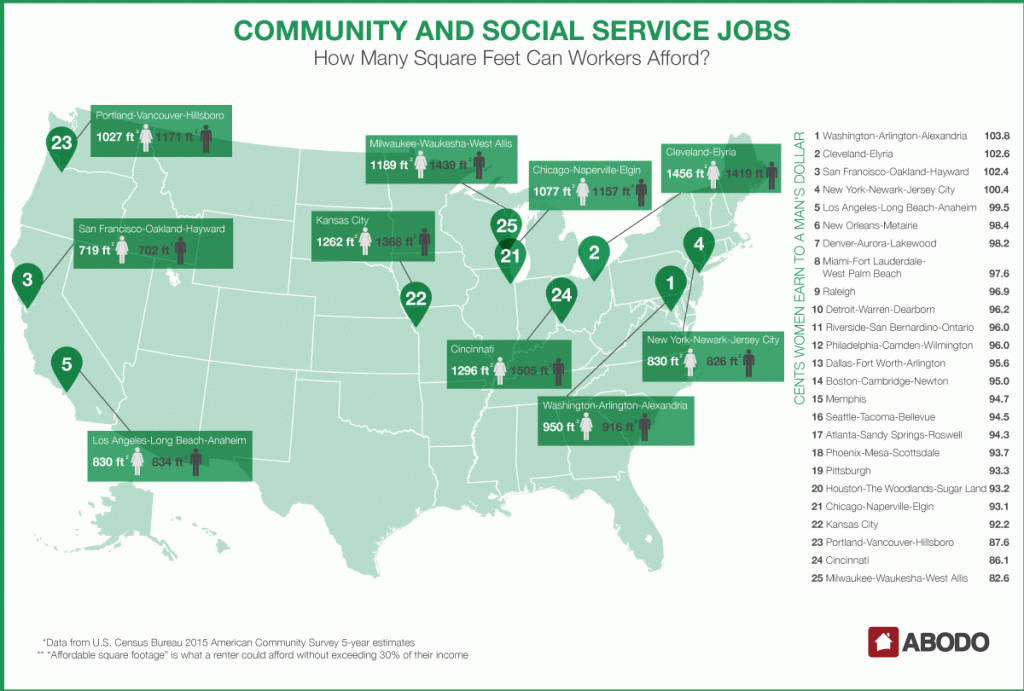

Community and Social Service Jobs

Community and social service jobs represented the fastest-growing sector of the American economy between 2012 and 2015. It’s a female-dominated field, with women making up 62% of its workers. Jobs in this category include social workers, probation officers, and counselors.

Of all the occupation categories we examined, community and social services had the most equal pay, with women earning 94% as much as their male counterparts. It was one of only two categories — construction and extraction was the other — in which women out-earned men in a select few MSAs.

In Washington-Arlington-Alexandria, DC-VA-MD-WV; Cleveland-Eyria, OH; San Francisco-Oakland-Hayward, CA; and New York-Newark-Jersey City, NY-NJ-PA; women earn a few cents more on the dollar than their male colleagues. And they need every one of those cents, because aside from Cleveland-Eyria, those MSAs have some of the highest rents in the country.

Although female workers in community and social service earn almost 4 cents more to the dollar than men in Washington, D.C., that discrepancy only translates to just 34 more square feet — for a 950-square-foot apartment, barely above the area median for one-bedrooms.

Compare that to Cleveland-Eyria, where a woman with a community and social service can afford a 1,456-square-foot apartment — 37 square feet more than a man in the same field.

The cities with the least equal pay in community and social service jobs were Milwaukee-Waukesha-West Allis, WI; Cincinnati, OH-KY-IN; Portland-Vancouver-Hillsboro, OR-WA; and Kansas City, MO-KS. In those MSAs, women in the field earned 83, 86, 88, and 92 cents to a man’s dollar, respectively.

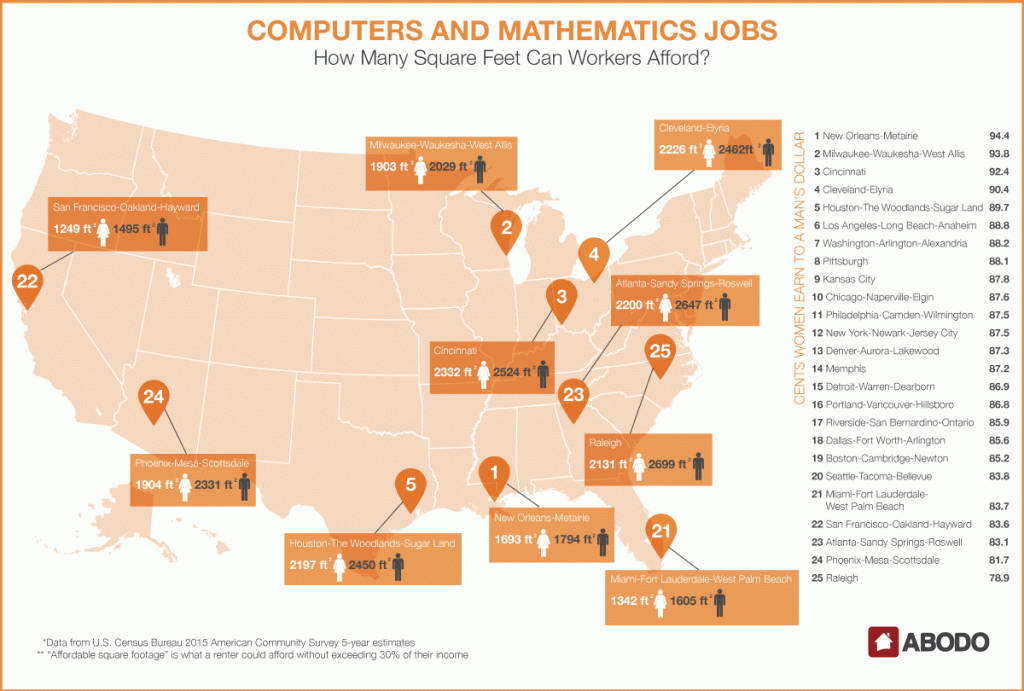

Computers and Mathematics Jobs

Perhaps as a reflection of this occupation’s reliance on forward-thinking methods — or as a result of decades of concerted efforts to recruit women into STEM professions — computers and math occupations have one of the lowest wage discrepancies, yet women comprise just about a quarter of employees. Women in these occupations, which include positions ranging from statisticians to IT support, earn 86.7% of what men earn.

More specifically, female software developers earn 86 cents to a man’s dollar, computer and information research scientists 74 cents, database admins 72 cents, and programmers 93 cents.

In New Orleans-Metairie, LA, women are just 5 cents below wage parity, giving them the best earning ratio in the country for tech jobs. Just behind NOLA is Milwaukee-Waukesha-West Allis, WI, where women earn 94 cents for every dollar earned by men. In terms of Milwaukee’s rental market, that means they can afford a 1,903-square-foot apartment, while men can afford about 2,029 square feet.

Raleigh, NC, does worst in this regard, with women earning less than 80% of what men earn. Women can afford 2,131-square-foot apartments, while men can afford nearly an extra 600 square feet.

Despite the fact that the city is nearly synonymous with the tech industry and Silicon Valley, San Francisco is near the bottom of this list, with the fourth-worst earning ratio of 83.6%. At the end of the day, women can afford to go home to 1,249 square feet, while men can afford 1,495.

Even tech giant Google, which has its Googleplex in nearby San Jose, isn’t immune to the wage gap phenomena. Currently, the Alphabet company and federal contractor is facing a lawsuit that the U.S. Labor Department says is due to “systemic compensation disparities” across the company’s vast workforce, though the company contests the claims.

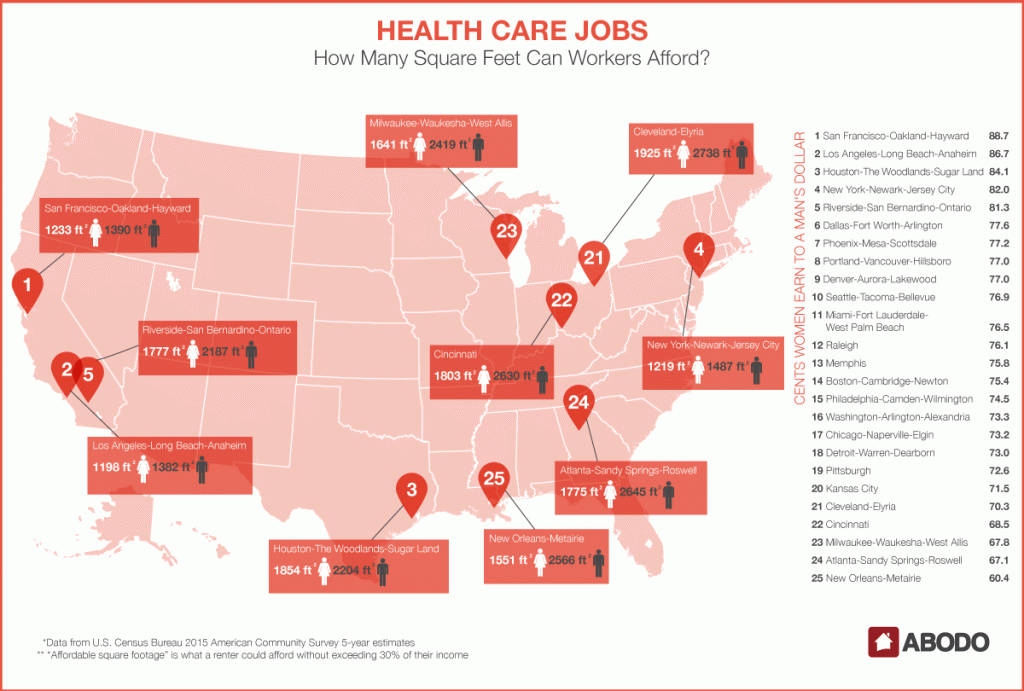

Health Care Jobs

Even though women comprise over 70% of its workforce, health care has one of the least equal pay structures of any of the fields we examined. That could be in part due to the wide spectrum of jobs under its umbrella. The job category includes doctors, surgeons, specialists, nurses, hospital administrators, technicians, and other positions. There’s a wide variation in salary.

Are women more heavily represented in lower-paying jobs within the industry? Perhaps — and that’s its own problem. But even in specific occupations in the field, there is often a wide gap in pay. The median income for female physicians and surgeons is $141,880, which is only 67.5% of their male counterparts’ figure of $210,078. Even resident nurse jobs, which have less variation in pay scale, tilt male. Women earn $63,014, 91.3% as much as their male counterparts.

The MSAs with the most equal pay in health care are San Francisco-Oakland-Hayward, CA; Los Angeles-Long Beach-Anaheim, CA; Houston-The Woodlands-Sugar Land, TX; and New York-Newark-Jersey City, NY-NJ-PA. Women earn about 89%, 87%, 84%, and 82% as much as men in those cities, but since each of those markets has high rent, discrepancies in pay result in big discrepancies in apartment size. In Houston, for example, women can afford 1,853 square feet of apartment — that’s twice the area’s median, but still significantly less than the 2,204 square feet a man in health care can afford.

Still, that’s nothing compared to the bottom of the list. In New Orleans-Metairie, LA; Atlanta-Sandy Springs-Roswell, GA; Milwaukee-Waukesha-West Allis, WI; and Cincinnati, OH; women earn under 70 cents to a man’s dollar, and can often afford significantly fewer square feet. In New Orleans, the discrepancy is particularly notable: While male health care professionals can afford to rent 2,566 square feet, women can only afford 1,551.

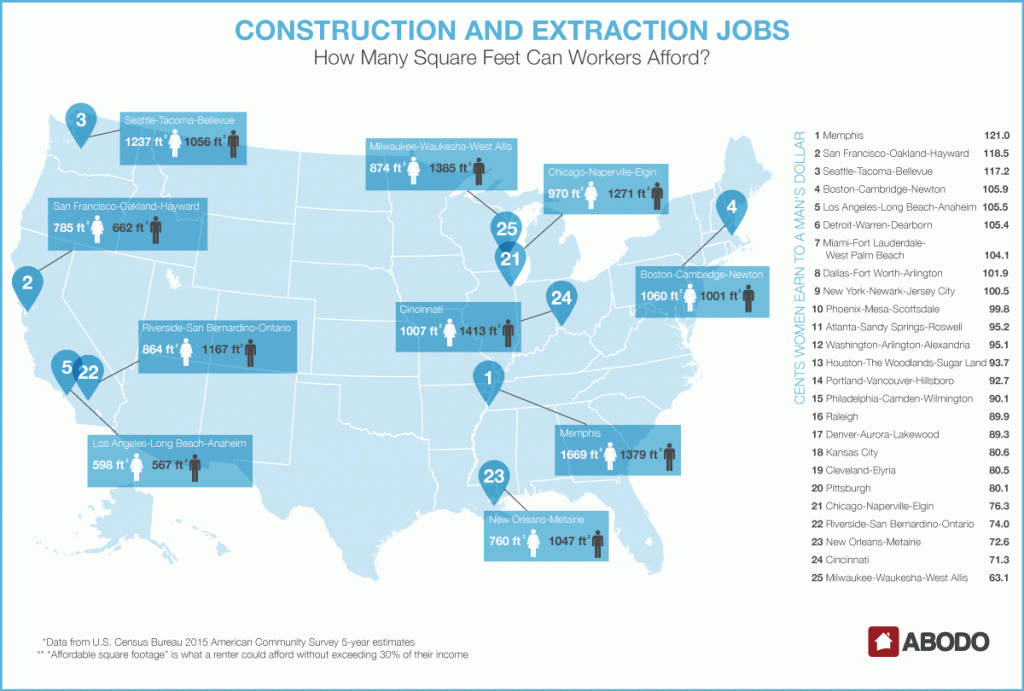

Construction and Extraction Jobs

Out of these five fastest-growing occupation categories, there are only two in which women earn as much as or more than men — and even then, it’s only in a specific set of cities. Surprisingly, one of those categories is construction and extraction, which has perhaps one of the most masculine connotations of any occupation we’ve examined. Just 2.4% of construction and extraction workers are women, which still adds up to more than 100,000 female workers.

Out of all of the Bureau of Labor Statistics’ occupation categories, construction and extraction has one of the best figures for wage parity: Women earn 88 cents for every dollar earned by men. (Only community and social services and installation, maintenance, and repair beat out this category, with 93.8 and 92.2, respectively.)

For first-line supervisors, women earn 89.6% of what men earn, and as inspectors about 85.1%. But for in the more hands-on jobs, wage parity is within reach: female laborers earn 96.7% of what men earn, and as helpers for construction trades, nearly 113%.

Although Milwaukee-Waukesha-West Allis, WI, earlier shone as a bright spot for women in tech, it offers a more meager measure when it comes to construction and extraction, earning the lowest score of any of our 25 metropolitan statistical areas: 63.1. In Milwaukee, where the median apartment is 900 square feet, a female in the construction industry could afford just 874 square feet, while men can get 1,385. Cincinnati, OH-KY-IN; New Orleans-Metairie, LA; Riverside-San Bernardino-Ontario, CA; and Chicago-Naperville-Elgin, IL-IN-WI, also had some of the lowest comparative pay for women, ranging from 71 cents to 76 cents.

But there is good news: In nine of the 25 MSAs we examined, women earned more than their male counterparts. Memphis, TN-MS, leads this charge, with women earning $1.20 to a man’s dollar. San Francisco-Oakland-Hayward, CA; Seattle-Tacoma-Bellevue, WA (the world’s crane capital due to the massive amounts of ongoing construction); Boston-Cambridge-Newton, MA-NH; and Los Angeles-Long Beach-Anaheim, CA, also excelled in this category.

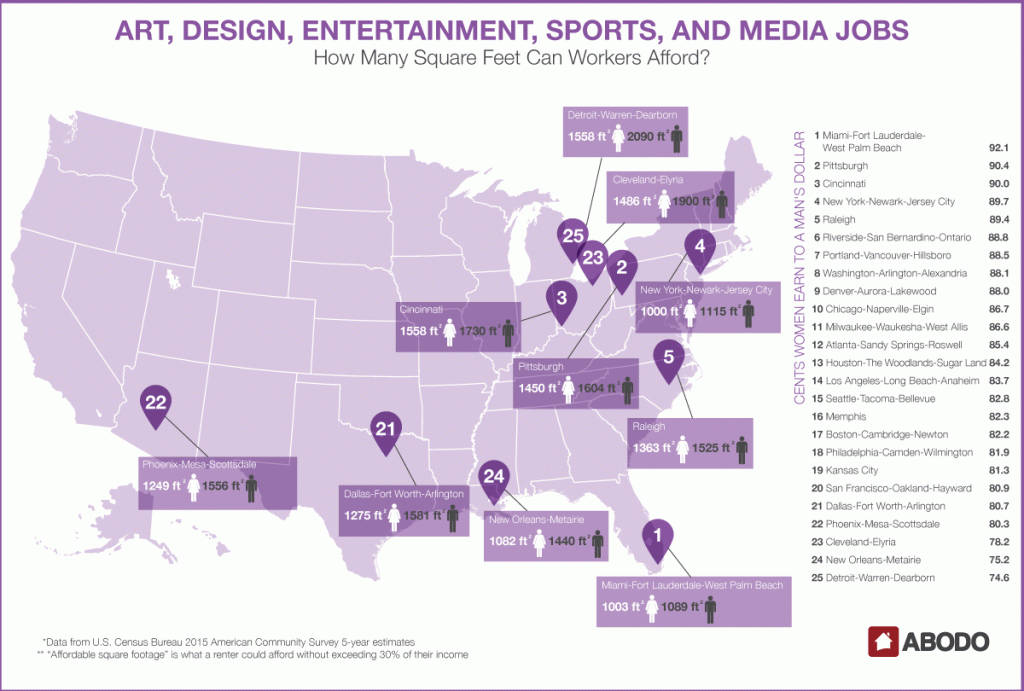

Art, Design, Entertainment, Sports, and Media Jobs

This job category includes a huge swath of professions: musicians, film editors, designers, artists, actors, journalists, and athletes, among others. The range of salaries within the category is immensely variable, but overall, the disparity between men’s and women’s income is slightly smaller than the national wage gap. Women in the field make a median income of $46,962, which is 85.8% as much as the median men’s income of $54,761.

The MSA with the smallest wage gap for art, design, entertainment, sports, and media jobs is Miami-Fort Lauderdale-West Palm Beach, FL, where women make 92 cents for every man’s dollar. Four other MSAs — Pittsburgh, PA (90.4%); Cincinnati, OH-KY-IN (90%); New York-Newark-Jersey City, NY-NJ-PA (89.7%); and Raleigh, NC (89.4%) — hover around the 90 cents-on-the-dollar mark.

Women in this job category face greater wage gaps in Detroit, MI (74.6%); New Orleans-Metairie, LA (75.2%); Cleveland-Elyria, OH (78.2%); Phoenix-Mesa-Scottsdale, AZ (80.3%); and Dallas-Fort Worth-Arlington, TX (80.7%). Of these cities, Detroit is the only one where a woman’s median salary exceeds the national median for women in the field. In Detroit, women in arts, entertainment, and media jobs earn a median salary of $49,868, which means they can afford to rent a 1,558-square-foot apartment. Men in the same field make $66,888 and can afford 2,090 square feet.

Recent criticism by several prominent actors, Amy Adams and Jennifer Lawrence among them, has brought renewed attention to disparities in pay in Hollywood. In Los Angeles, which has the country’s highest concentration of jobs in this category, women earn 83.7% as much as men. And the gap in pay for actors, specifically, is a similar figure: women earn 84.1% as much as their male colleagues.

Conclusion

For the most part, we’ve narrowed our examination of wage trends to first the 100 largest MSAs and then the 25 largest MSAs, using 5-year estimates. But if we look at all MSAs in the country based on 2015 Census 1-year estimates, there are still just two in which women earn at least as much as men earn. Interestingly, they’re both in New Mexico: Santa Fe and Las Cruces. In the 5-year estimates, however, there are none. Likewise, there is no occupation category in which women’s earnings match men’s earnings dollar for dollar.

Is it an occupational choice? Do women choose to limit themselves to lower-paying jobs? Possibly, but out of 525 specific job titles, there are just 27 where women earn at least as much as men. Is it because women are typically less likely to negotiate salaries, and are more likely to experience backlash when they do? That’s also a possibility.

Regardless, lower earnings have concrete consequences, and not only on payday. Wage disparities can limit an individual worker’s economic mobility and even their ability to get hired in the future. For example, employers could look at the disparate salaries of two candidates for a job, and perhaps assume that the higher-earner is a harder worker. To combat that trend, laws are popping up, such as in Philadelphia, to ban employers from asking applicants to disclose wage history — that helps lower-earning women as well as other poorly compensated employees from falling farther behind in the wage race.

Also among the consequences: housing affordability. As a national median, women can afford 1,143 square feet, while men can afford up to 1,448. But, as we all know, you can’t order a specified number of square feet for your apartment, which often translates to a tight budget stretched to fit the market reality. As housing costs continue to rise faster than wages, this gap will only become more pronounced.

For press inquiries, contact Sam Radbil.

Methodology

We analyzed data from the U.S. Census Bureau’s 2015 American Community Survey 5-year estimates for the median salaries of male and female full-time, year-round workers who were at least 16 years old and with earnings. We identified the 10 MSAs (of the 100 largest by population) with the largest and smallest wage gaps, as well as the five occupations with the largest and smallest wage gaps nationally.

For each of the five occupations that had the greatest growth in employment from 2012 to 2015, we calculated how many square feet a male and female worker earning a median salary in their occupation could afford to rent in each of the 25 MSAs included in the 2015 American Housing Survey. In this calculation, we used the median rent per square foot for each MSA and defined “affordable” as 30% of the median income, following guidance from the U.S. Department of Housing and Urban Development regarding housing-cost burdens.