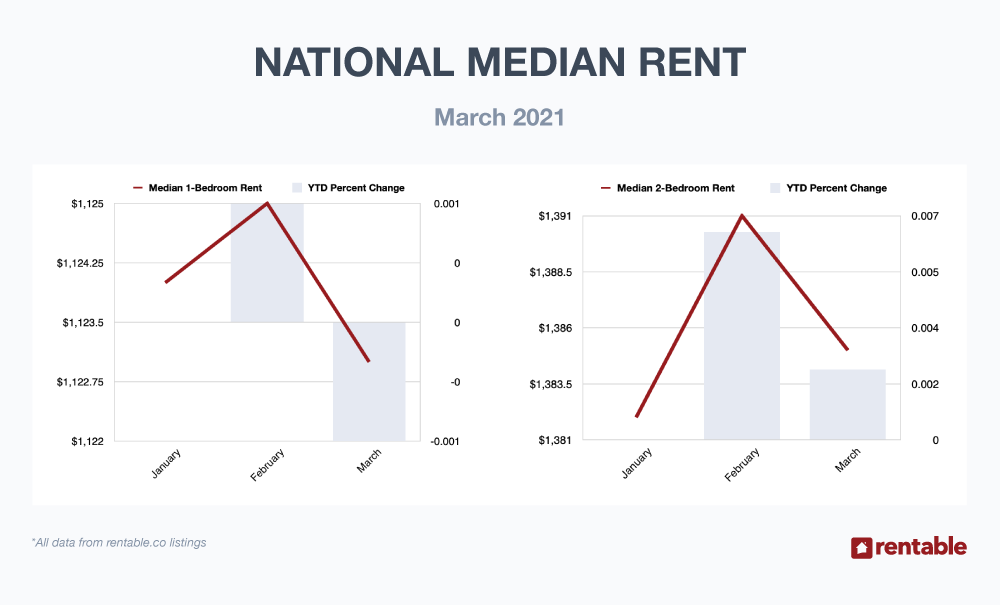

National median one-bedroom apartment rents actually fell 0.09 percent in March to a median $1,123 and two-bedroom units gained a tiny 0.22 percent to a median $1,385 No city moved more than 9 percent in any of our top ten loser and gainer lists—a strong indication of a lackluster market as double-digit gainers and/or losers were not apparent.

Notably, for the first time in seven months, we did not see San Francisco, CA on any of our lists.

Let’s look at March in detail:

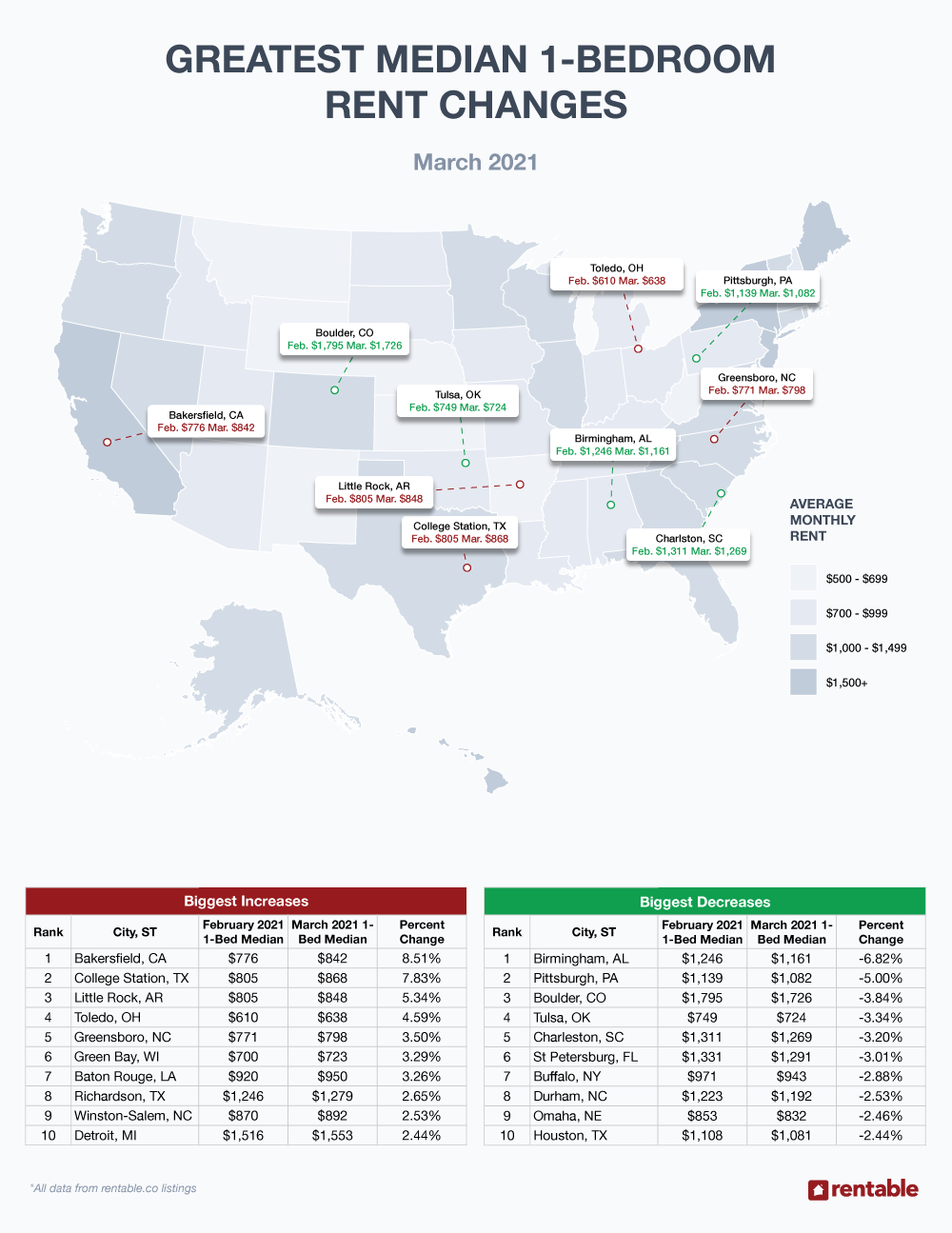

1-Bedroom Apartments

Our top-ten gainers stayed in a tight range as less than 3 percent separated the first-place city from the last. The losers list range was also muted as just a little more than 4 percent separated our first and last place cities.

Upward Movers

Bakersfield, CA led our one-bedroom gainers list with a solid 8.51 percent gain to a median $842. College Station, TX followed with a 7.83 percent gain on top of last month’s 6.34 percent gain.

Little Rock, AK added 5.34 percent, Toledo, OH rose 4.59 percent, and Greensboro, NC posted a 3.50 percent gain to a median $798,

Green Bay, WI, and Baton Rouge, LA increased by 3.29 and 3.26 percent respectively; Richardson, TX rose a non-exciting 2.65 percent.

Finally, Winston-Salem, NC and Detroit, MI reported increases of 2.53 and 2.44 percent.

The most expensive one-bedroom on our gainers list was surprisingly Detroit, MI at $1,553 while the most affordable was again Toledo, OH at $638.

Downward Movers

Birmingham, AL topped our top ten one-bedroom median rent decreasers list with a loss of 6.82 percent to $1,161. Pittsburgh, PA fell an even 5.00 percent, and Boulder, CO took third place with a 3.84 percent loss. Tulsa, OK was close behind with a 3.34 percent drop to $724.

Charleston, SC lost 3.20 percent and St. Petersburg, FL dropped 3.01 percent. Buffalo, NY lost 2.88 percent to settle at $943.

Durham, NC dropped 2.53 percent to $1,192 and Omaha, NE dropped 2.46 percent. Finally, Houston, TX lost 2.44 percent but remained over the thousand-dollar mark at $1081.

Those looking for pure value should head to Tulsa, OK where a one-bedroom apartment rented for an affordable $724. With San Francisco, CA off of this list, St. Petersburg, FL became march’s most expensive one-bedroom median unit at $1,291.

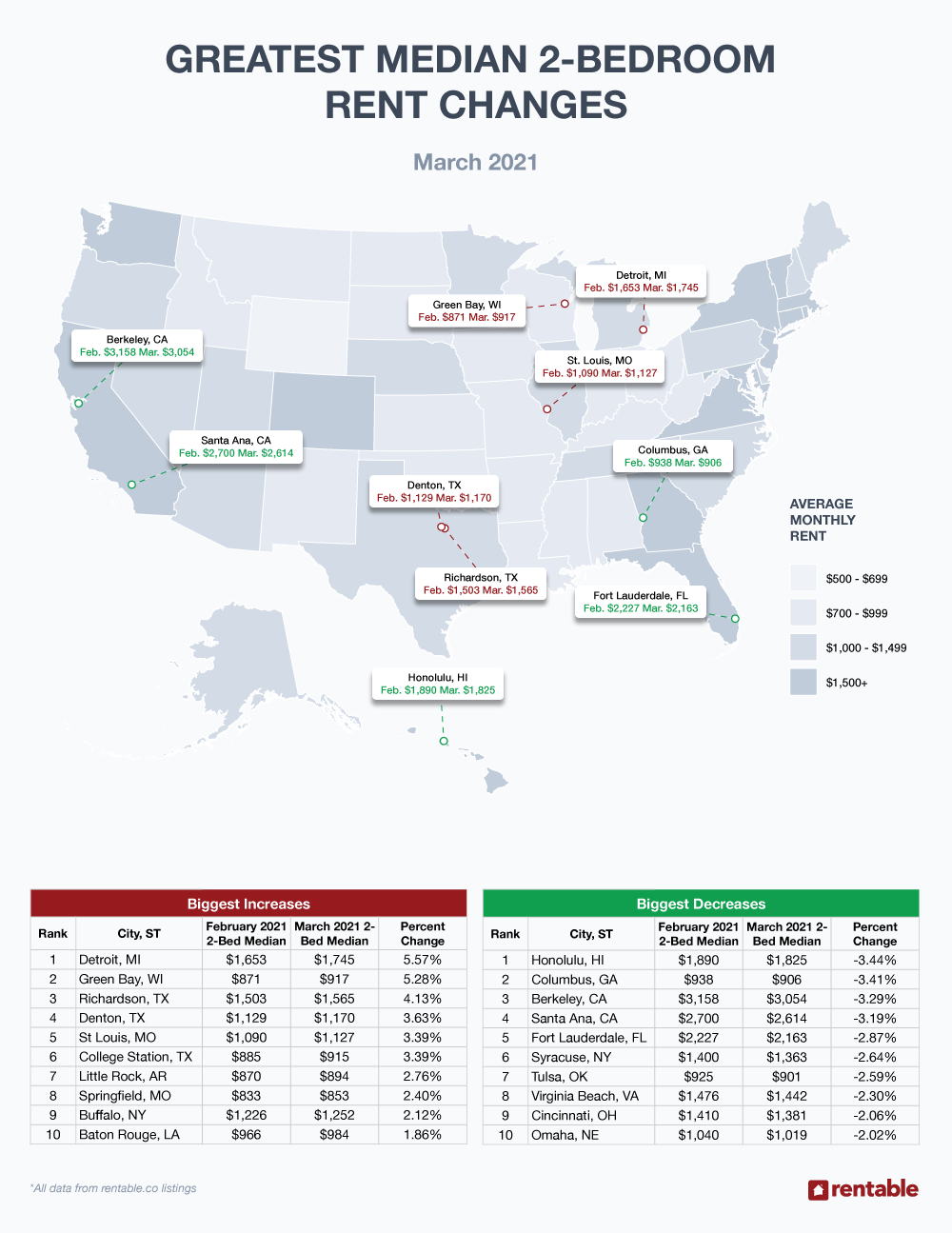

2-Bedroom Apartments

We saw tight ranges in both our 2-bedroom gainers and losers lists. Just over 3.5 percent separated the first and last place cities on our gainers list, and our decreasers reported a record low spread of less than 1.42 percent. Again, this means that the market is not moving with any strength in either direction.

Upward Movers

Detroit, MI led the gainers with an upward move of 5.57 percent to $1,745 while Green Bay, WI placed second on our list rising 5.28 percent. Richardson, TX added a healthy 4.13 percent and Denton, TX gained 3.63 percent at $1,170.

St. Louis MO reported a rise of 3.39 percent. College Station, TX moved upward by 3.39 percent and Little Rock, AR and Springfield, MO added 2.76 and 2.40 percent, respectively. Bakersfield’s median rent was $1,121; Springfield, MO’s price tag was $853.

A Buffalo, NY two-bedroom could be rented for $1,252, as that locale rose 2.12 percent. Lastly, Baton Rouge, LA reported a small move of 1.86 percent to a median $984.

Springfield, MO was the cheapest two-bedroom median rent on our losers list at $853; Detroit, MI took the prize for the priciest at $1,745.

Downward Movers

Honolulu, HI’s two-bedroom median rent fell $65 to $1,825. Columbus, GA lost 3.41 percent to settle at $906 Berkeley, CA, Santa Ana, CA, Fort Lauderdale, FL and Syracuse, NY all lost between 2.64 and 3.29 percent.

Tulsa, OK fell 2.59 percent to $901. Virginia Beach, VA and Cincinnati, OH lost a respective 2.30 and 2.06 percent, and finishing our two-bedroom losers list, Omaha, NE fell 2.02 percent.

Tulsa, OK was a nice two-bedroom value at only $901, and Berkeley, CA was still expensive as it remained over 3K at $3,054.

Rent Report Recap & What’s Next?

The stock market showed signs of both frothiness and weakness while the long-suffering bond market attempted to rally. Oil prices remained over $60 per barrel, and energy-rich Texas ran out of gas (natural, that is), as a late seasonal Arctic air intrusion lunged the state into darkness as the power grid came perilously close to complete failure. COVID-19 vaccine production was on the rise and as of this writing, almost 10 percent of Americans had been vaccinated.

What does all of the above mean for apartment rentals in the coming months? Consider these facts:

- There is tremendous Fed-enhanced liquidity in the financial system and eventually, that will translate to inflation.

- The COVID-19 fight is at a crucial cornerstone, but more vaccine doses are arriving daily.

- A huge stimulus bill is about to become law.

- If COVID-19 is indeed on the run, consumers are going to come out from hiding and start spending.

While we may not see the trend in earnest next month, we now look for higher rent prices as 2021 moves forward as we feel the factors of inflation paired with better news on the COVID-19 front will put pressure on apartment rents. We’re also paying close attention to homebuying trends, specifically within the Millennial age group, and how sales and prices may impact rentals going forward.

Be sure to tune in next month for our April update.

Methodology

Each month, using millions of Rentable listings across the United States, we calculate the median 1-bedroom and 2-bedroom rent prices by city, state, and nation, and track the month-over-month percent change. To avoid small sample sizes, we restrict the analysis for our reports to cities meeting minimum population and property count thresholds.

For press inquiries, please contact Sam Radbil.