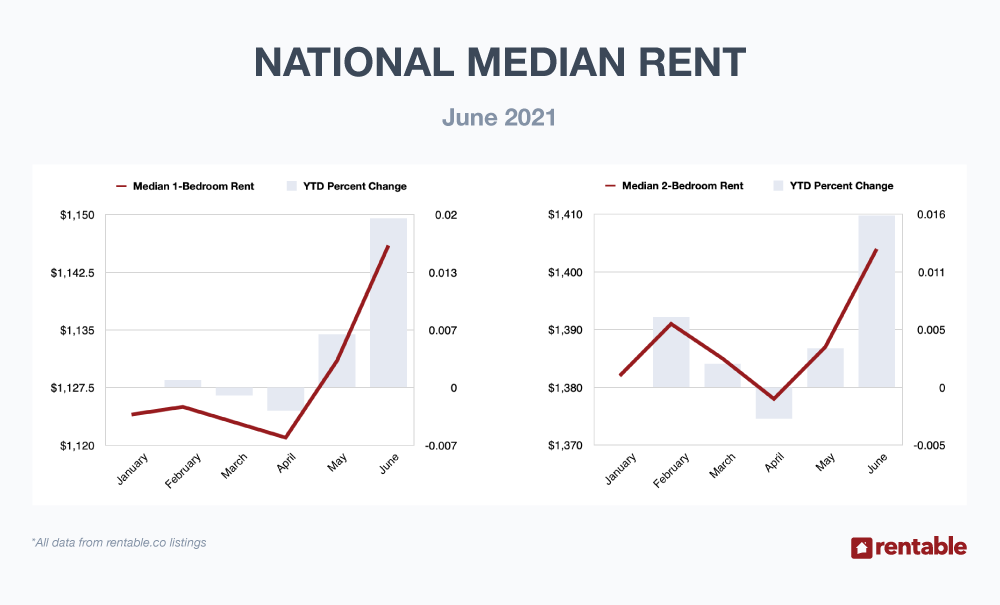

Last month our prediction was, “look for near-term apartment rental prices to trudge upward,” and our June median rental stats affirm this trend as one-bedroom prices moved upward 1.34 percent while two-bedroom units rose 1.23 percent.

These are significant monthly increases, and one-bedrooms are up almost 2 percent for the year while two-bedrooms have gained over 1.5 percent.

Let’s analyze June’s stats.

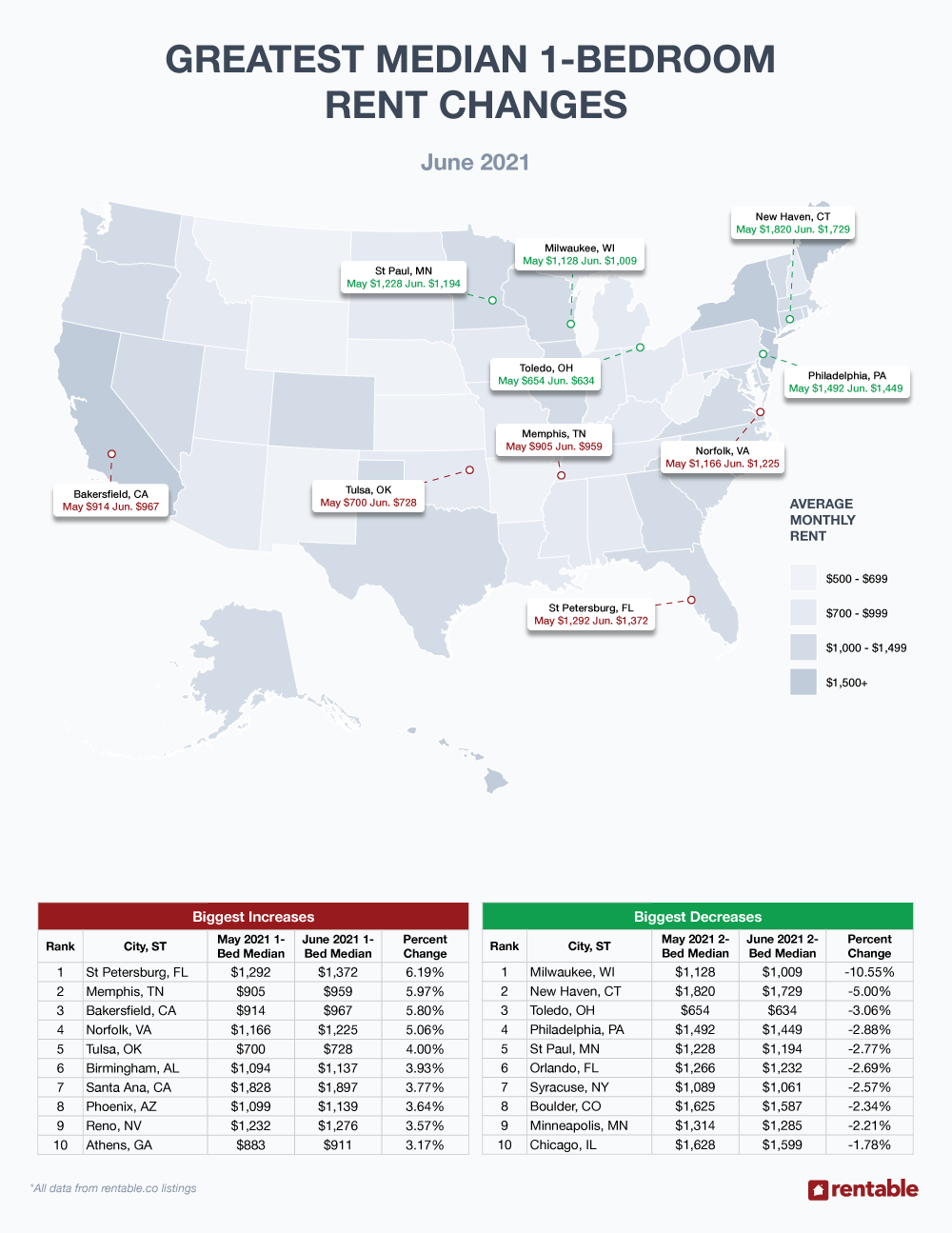

1-Bedroom Apartments

Our top-ten gainers did remain in a tight range as just over 3 percent separated the first-place city from the last, but the losers list was much more active as greater than 8 percent divided the first locale from the tenth.

Upward Movers

St. Petersburg, FL led our one-bedroom gainers list with a 6.19 percent gain to a median $1,372. Memphis, TN followed with a 5.97 percent gain, Bakersfield, CA rose 5.80 percent, and Norfolk, VA pushed upward by 5.06 percent to a median $1,225. Tulsa, OK rose an even four percent.

Price gains on our list after those five cities were more subdued.

Birmingham, AL added 3.93 percent, Santa Ana, CA rose 3.77 percent to a median $1,897, and Phoenix, AZ posted a 3.64 percent gain.

Finally, Reno, NV and Athens, GA reported respective gains of 3.57 and 3.17 percent.

The most expensive one-bedroom on our gainers list was Santa Ana, CA while the most affordable was Tulsa, OK at $728.

Downward Movers

Midwestern gem Milwaukee, WI saw its two-bedroom median rent fall as precipitously as the Milwaukee Bucks 2020 season with a big loss of 10.55 percent to $1,009. New Haven, CT fell again in June with a loss of 5 percent, and Toledo, OH took third place with a 3.06 percent loss. Philadelphia, PA was close behind with a 2.88 percent drop to $1,449.

St. Paul, MN lost 2.77 percent and Orlando, FL dropped 2.69 percent. Syracuse, NY dropped to $1,061—a loss of 2.57 percent. Minneapolis, MN fell 2.21 percent to settle at a median $1,285.

Finally, Chicago, IL lost 1.78 percent at a median one-bedroom June rent of $1,599. San Francisco, CA was again absent from our top ten losers.

Those looking for pure value should head to Toledo, OH where a one-bedroom apartment rented for a pleasantly low $634. New Haven, CT was the priciest one-bedroom on our losers list at $1,729.

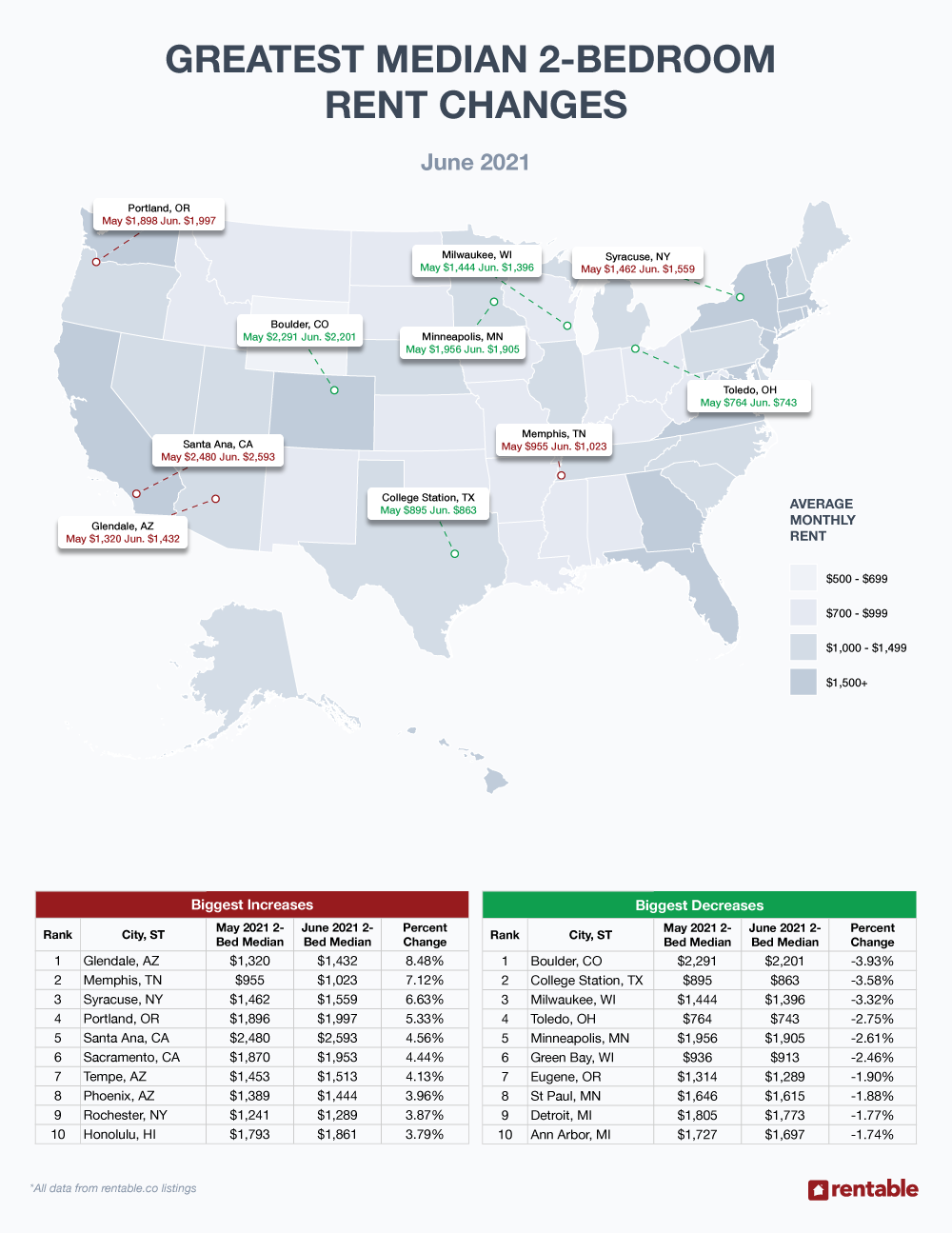

2-Bedroom Apartments

In June we saw bigger spreads between the top ten two-bedroom gainers than the top 10 losers with more than 4 percent separating the top from the bottom. The losers were more consolidated with only slightly more than 2 percent separating the worst from the first.

Upward Movers

Glendale, AZ led the gainers with a big upward move of 8.48 percent to $1,432 while Memphis, TN placed second on our list rising 7.12 percent. Syracuse NY added a healthy 6.63 percent and Portland. OR gained 5.33 percent at a median $1,997.

Santa Ana, CA reported a rise of 5.33 percent. Sacramento, CA moved upward by 4.44 percent and Tempe, AZ, at a median $1,512, moved upward by 4.13 percent.

Phoenix added a solid 3.96 percent, Rochester, NY tacked on 3.87 percent, and finally, Honolulu, HI reported a median June two-bedroom rent of $1,861, —a 3.79 percent increase.

Memphis, TN was the cheapest two-bedroom median rent on our losers list at $1,023, while Santa Ana, CA took the prize for the priciest at $2,593.

Downward Movers

Boulder, CO’s two-bedroom median rent fell 3.93 percent—the second month in a row that Boulder took first place on the two-bedroom losers’ list. College Station, TX lost 3.58 percent to settle at $863, and whatever is brewing in Milwaukee, WI is not good, as that city’s two-bedroom median rent fell 3.32 percent to $1,396.

Toledo OH dropped 2.75 percent, and Minneapolis, MN fell 2.61 percent to a median June two-bedroom rent of $1,905. Green Bay, WI, and Eugene, OR fell 2.46 and 1.90 percent respectively; St. Paul. MN lost between 1.88 percent, and Detroit, MI saw its June median rent crumble to $1,773, a loss of 1.77 percent. Finally, Ann Arbor, MI fell 1.74 percent.

Note that eight of the ten cities that appeared on our top ten losers list were located in the rust belt.

Toledo, OH was again a great two-bedroom value at only $734, Boulder, CO was the most expensive at $2,201.

Rent Report Recap & What’s Next?

The pandemic looks to be on the run as the economy tries to conquer the supply and pricing challenges of a post-pandemic era.

Inflation has reared its ugly head as consumers experience sticker shock at the grocery store, car dealerships, and big-box home supply stores. On top of that indignity, shortages of many products continue to plague the retail landscape. Computer chips are hard to find, and subsequently, partly finished autos are being stockpiled as they wait for component parts that will energize their computers.

The price of oil, seemingly driven by a perceived higher future demand, has comfortably climbed over the $60 per bbl. range. When the price of oil rises, any goods made with petroleum products become more expensive, and that also leads to inflationary pressure.

So, what does all of this mean for July apartment rents? Any business owner knows that one of the most convenient excuses for a price increase is inflation. With rapidly rising costs, it is easy to jump on the bandwagon and declare that because of inflation, rents must move higher.

Therefore, if the expanding economy and the concurrent supply-shortage driven price increase continue, we see July rents continuing the upward trend.

Be sure to check in next month.

Methodology

Each month, using millions of Rentable listings across the United States, we calculate the median 1-bedroom and 2-bedroom rent prices by city, state, and nation, and track the month-over-month percent change. To avoid small sample sizes, we restrict the analysis for our reports to cities meeting minimum population and property count thresholds.

For press inquiries, please contact Sam Radbil.