Last month our prediction was, “If the expanding economy and the concurrent supply-shortage driven price increases continue, we see July rents continuing the upward trend,” and that scenario strongly verified. July one-bedroom units were up a little over 1.4 percent while two-bedroom rose 1.23 percent.

One-bedrooms are now up 3.38 percent for the year and two-bedrooms have gained 2.82 percent.

Let’s analyze July’s stats.

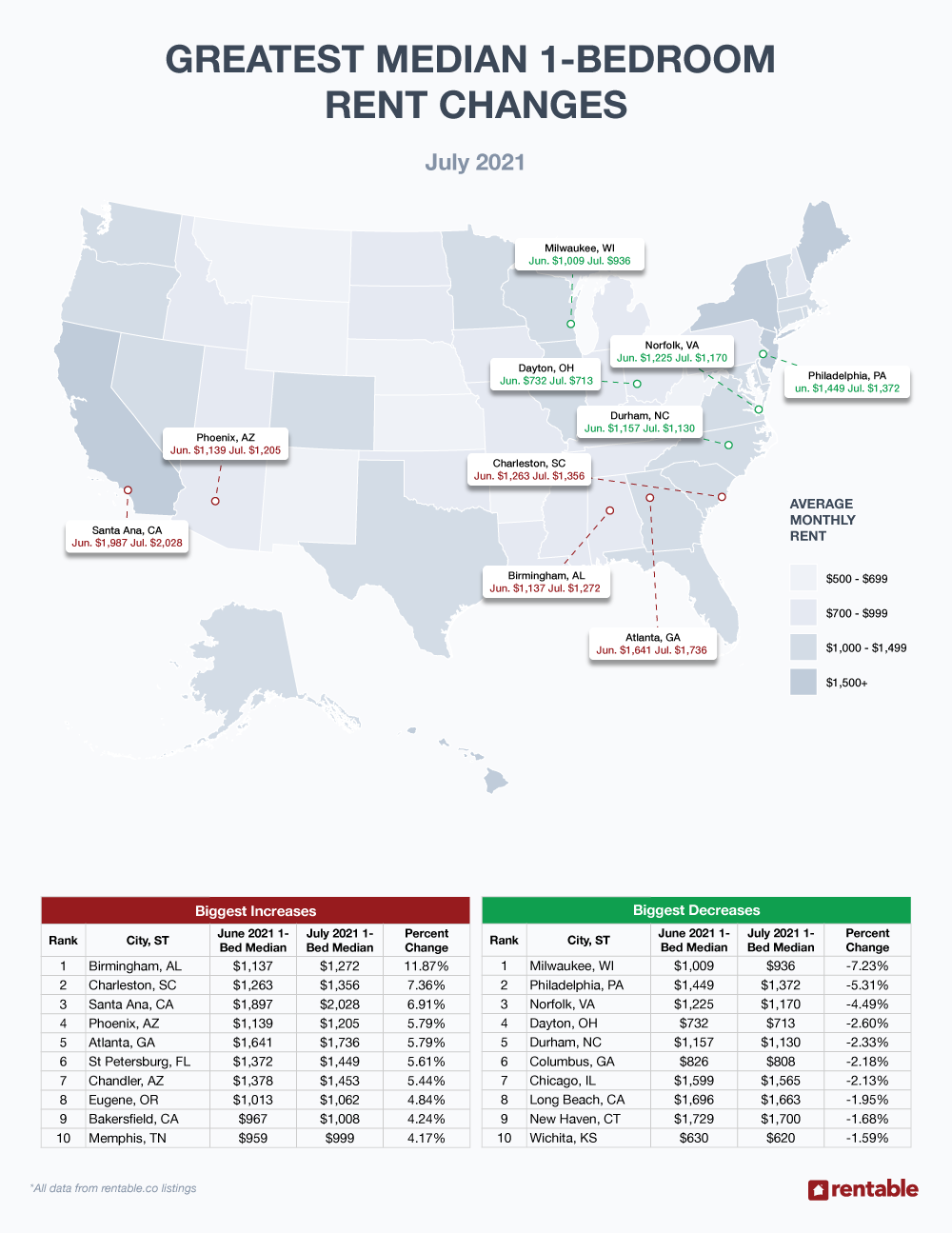

1-Bedroom Apartments

Our top-ten gainers broke out of their tight range as just over 7 percent separated the first-place city from the last, and the losers list was also relatively active as greater than 5 percent divided the first locale from the tenth.

Upward Movers

Birmingham, AL led our one-bedroom gainers list with a big 11.87 percent gain to a median $1,272. Charleston, SC followed with a 7.36 percent gain, Santa Ana, CA rose 6.91 percent, and Phoenix, AZ pushed upward by 5.79 percent to a median $1,205. Atlanta, GA rose 5.79 percent to a median $1,736.

Price gains on our list after those five cities were also more substantial than we have seen in months.

St. Petersburg, FL added 5.61 percent, Chandler, AZ rose 5.44 percent to a median $1,453 and Eugene, OR posted a 4.84 percent jump.

Finally, Bakersfield, CA and Memphis, TN reported respective gains of 4.24 and 4.17 percent.

The most expensive one-bedroom on our gainers list was Santa Ana, CA at a median $2,028 while the most affordable was Memphis, TN, barely under the $1,000 mark at $999.

Downward Movers

Beery and dreary Milwaukee, WI saw its one-bedroom median rent fall again with a significant loss of 7.23 percent to $936. Philadelphia, PA fell 5.31 percent, and Norfolk, VA took third place with a 4.49 percent loss. Dayton, OH was next, but with a smaller 2.60 percent drop to $713.

Durham, NC lost 2.33 percent and Columbus, GA dropped 2.18 percent. Chicago, IL sunk to $1,565—a loss of 2.13 percent. Long Beach CA fell 1.95 percent to settle at a median $1,663, and New Haven, CT dropped 1.68 percent to settle at a July median rent of an even $1,700.

Finally, Wichita, KS lost 1.59 percent.

Interestingly, San Francisco, CA was again absent from our top ten losers list, continuing to hold its ground after months of serious declines.

Those looking for pure value should head to Toledo, OH where a one-bedroom apartment rented for a pleasantly low $620. New Haven, CT was the priciest one-bedroom on our losers list at $1,700.

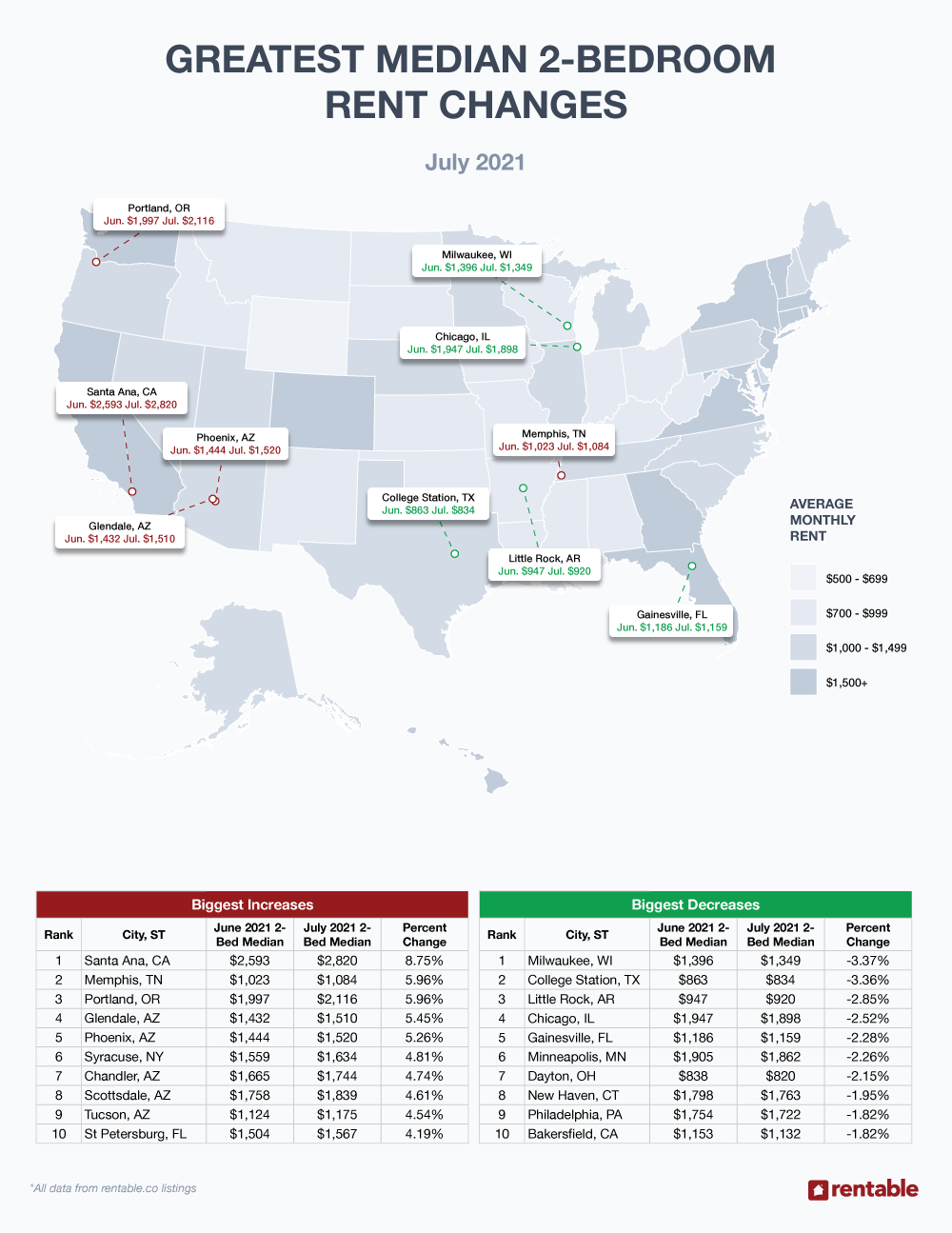

2-Bedroom Apartments

In June we saw bigger spreads between the top ten two-bedroom gainers versus the top 10 losers. While more than 4.5 percent separated the gainers from top to bottom, the losers were more consolidated with less than 2 percent separating the worst from the first. Remember, understanding these numbers will be hugely helpful in knowing what you can afford each month.

Upward Movers

Half of our top ten two-bedroom gainers were in Arizona, and we’ve never seen a single state dominate one of ours lists in this manner.

Santa Ana, CA led the gainers with a big upward move of 8.75 percent to $2,820, while Memphis, TN placed second on our list rising 5.96 percent on top of June’s gain of 7.12 percent. Portland, OR added a healthy 5.96 percent and Glendale, AZ gained 5.45 percent at a median $1,510.

Phoenix reported a rise of 5.26 percent. Syracuse, NY moved upward by 4.81 percent and Chandler, AZ, at a median $1,744, moved upward by 4.74 percent.

Scottsdale, AZ added a solid 4.61 percent, Tucson, AZ tacked on 4.54 percent, and finally, St Petersburg, FL reported a median June two-bedroom rent of $1,567 — a 4.19 percent increase.

Memphis, TN posted the cheapest two-bedroom median rent on our losers list at $1,084, while Santa Ana, CA took the prize for the priciest at $2,820.

Downward Movers

Milwaukee, WI just can’t get out of its own way as the city’s two-bedroom median rent fell 3.37 percent to $1,349. College Station, TX lost 3.36 percent to settle at $834; Little Rock, AR dropped 2.85 percent, and Chicago, IL moved downward to a median $1,898.

Gainesville, FL dropped 2.28 percent, and Minneapolis, MN fell 2.26 percent to a median June two-bedroom rent of $1,862. Dayton, OH and New Haven, CT lost 2.15 and 1.95 percent respectively; Both Philadelphia, PA and Bakersfield, CA sunk an identical 1.82 percent.

Dayton, OH was again a great two-bedroom value at only $820, and Minneapolis, MN was the most expensive at $1,898— but still well under the $2,000 mark.

Rent Report Recap & What’s Next?

Variants aside, the Covid-19 pandemic seems to be losing its grip in the United States even though vaccination rates continue to lag behind what is considered optimal.

Last month we mentioned that “Inflation has reared its ugly head as consumers experience sticker shock at the grocery store, car dealerships, and big box home supply stores. On top of that indignity, shortages of many products continue to plague the retail landscape. Computer chips are hard to find, and subsequently, partly finished autos are being stockpiled as they wait for component parts that will energize their computers.”

Unfortunately, nothing has changed in the inflation department, and if anything, prices are continuing to quickly move upward. For example, a box of plastic contractor trash bags that cost around $15.00 a couple of years ago are now priced just below $30.00, and examples like that abound.

The laws of supply and demand rule, and with immense post-pandemic consumer demand, prices just keep rising, and this upward pressure continues to spill into apartment rental arena. While the supply and demand issue will eventually balance itself, until we see interest rate increases that may result in a weakening economy, look for summer one and two-bedroom rent prices to escalate.

Be sure to check in next month.

Methodology

Each month, using millions of Rentable listings across the United States, we calculate the median 1-bedroom and 2-bedroom rent prices by city, state, and nation, and track the month-over-month percent change. To avoid small sample sizes, we restrict the analysis for our reports to cities meeting minimum population and property count thresholds.

For press inquiries, please contact Sam Radbil.