National median one- and two-bedroom apartment rent prices both declined in April as one-bedroom units lost 0.27 percent to a median $1,121 while two-bedroom spaces fell 0.29 percent to $1,378. Tight ranges were observed in both our one- and two-bedroom top ten charts as we saw no dramatic price moves.

Let’s analyze April’s stats.

1-Bedroom Apartments

Our top-ten gainers stayed in a tight range as less than 4 percent separated the first-place city from the last. The losers list was almost identical as less than 4 percent also divided the first locale from the tenth.

Upward Movers

As we just mentioned above, Norfolk, VA led our one-bedroom gainers list with a hardly-stellar 6.03 percent gain to a median $1,091. College Station, TX followed with a 5.76 percent gain, and that was it for the biggest one-bedroom moves.

Dayton, OH added 5.65 percent, Bakersfield, CA rose 5.46 percent to a median $888, and Little Rock, AK posted a 4.72 percent gain to an identical $888.

Baton Rouge, LA and Columbus GA increased by 3.58 and 3.67 percent respectively, and Greensboro, NC rose a non-exciting 3.47 percent.

Finally, Reno NV and Toledo, OH reported increases of 3.47 and 2.82 percent.

The most expensive one-bedroom on our gainers list was Reno, NV at $1,194, while the most affordable was Toledo, OH at $656.

Downward Movers

Birmingham, AL topped our top ten one-bedroom median rent decreasers list with a loss of 6.20 percent to $1,089, Eugene, OR fell a more moderate 6.14 percent, and Pittsburgh, PA took third place with a 5.64 percent loss. Milwaukee, WI was close behind with a 4.02 percent drop to $1,219.

Cincinnati, OH lost 3.40 percent and Buffalo, NY dropped 3.29 percent. St. Petersburg, FL dropped to $1,251—a loss of 3.10 percent. Cheap El Paso, TX fell just over 3 percent to settle at a median $798.

Finally, Boulder, CO lost 2.72 percent and Houston TX lost 2.68 percent at a median one-bedroom April rent of $1,052.

Of note, San Francisco, CA was finally and conspicuously absent from our top ten losers list possibly signaling post-pandemic rent consolidation

Those looking for pure value should head to El Paso, TX where a one-bedroom apartment rented for a comfortable $798. Boulder, CO was the priciest one-bedroom on our losers list at $1,679.

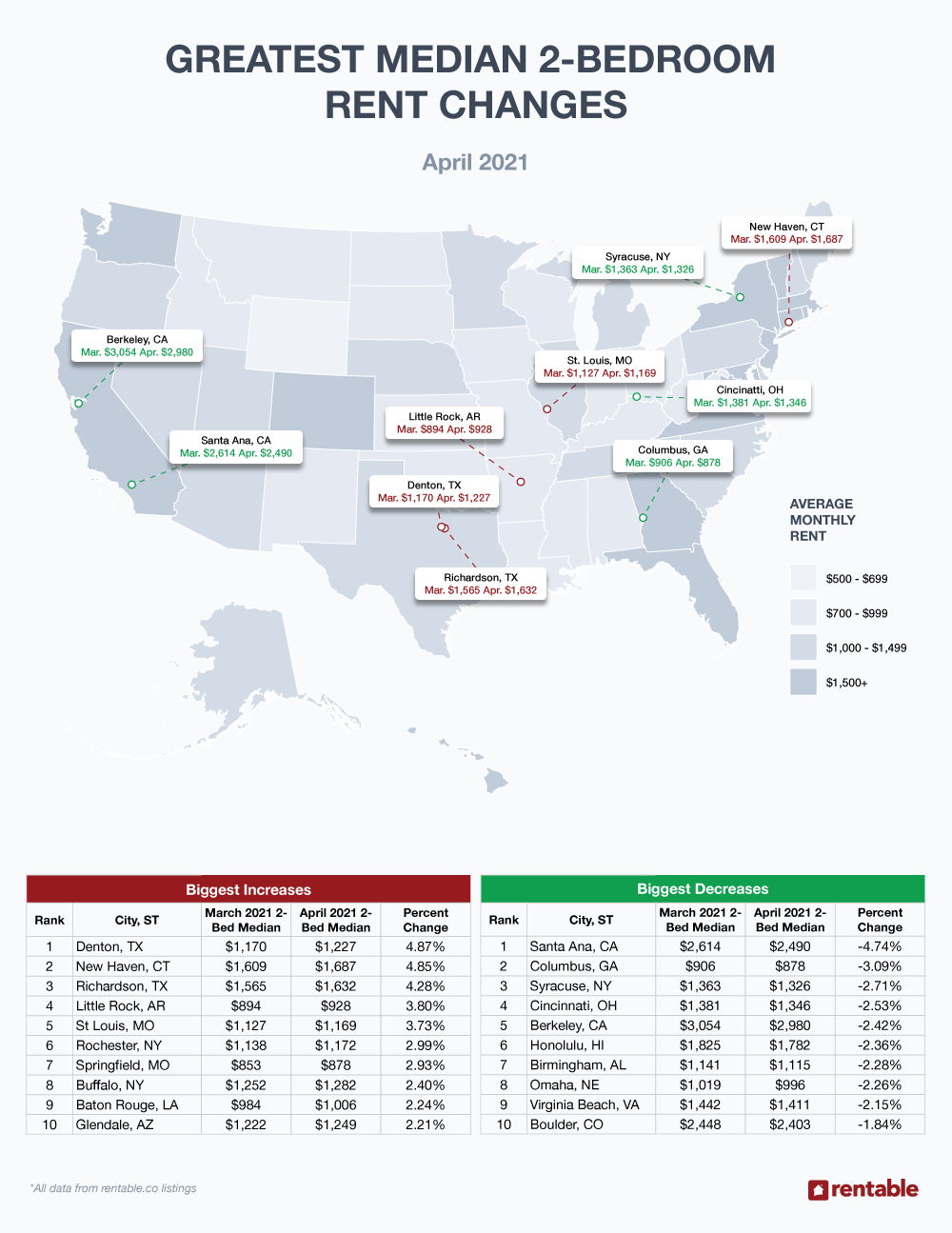

2-Bedroom Apartments

Again, in April we saw tight ranges in both our 2-bedrroom gainers and losers lists. Just over 2.5 percent separated the first and last place cities on our gainers list, and our decreasers reported a spread of less than 3.0. This simply means that the market is not moving with strength in either direction.

Upward Movers

Denton, TX led the gainers with an upward move of 4.87 percent to $1,227 while New Haven, CT placed second on our list rising 4.85 percent. Richardson, TX added a healthy 4.28 percent and Little Rock, AR gained 3.80 percent at a median $928.

St. Louis, MO reported a rise of 3.73 percent. Rochester, NY moved upward by 2.99 percent and Springfield, MO, at a median $878, gained 2.93 percent.

Buffalo, NY added a paltry 2.40 percent, Baton Rouge, LA tacked on 2.24 percent, and finally, Glendale, AZ reported a median April two-bedroom rent of $1,249—a 2.21 percent increase.

Springfield, MO was the cheapest two-bedroom median rent on our losers list at $878; And surprisingly, Richardson, TX took the prize for the priciest at $1,687.

Downward Movers

Santa Ana, CA’s two-bedroom median rent fell $124 to $2,490. Columbus, GA lost 3.09 percent to settle at $878, and Syracuse, NY, Cincinnati, OH, and Berkeley, CA all lost between 2.36 and 2.53 percent.

Honolulu, HI dropped 2.36 percent, and Birmingham, AL and Omaha, NE lost between 2.26 and 2.28 percent. Finishing our two-bedroom losers list, Virginia Beach, VA lost a 2.15 percent to $1,411 while Boulder, CO fell 1.84 percent.

Columbus, GA was a nice two-bedroom value at only $878, and Berkeley was its usual expensive self at $2,980.

Rent Report Recap & What’s Next?

The U.S. economy political arena has been dominated by the pandemic for over one and one-quarter years. And while pundits had warned the quickly recovered stock market was ready for another sharp fall, this has not occurred as retail investors who have been playing the market with government stimulus money from their home offices continue to heavily buy the dips.

The price of crude oil has stealthily risen and is hovering near or slightly above the $60 per bbl. mark. Across the country, new and used home inventories are at record lows and this anomaly has set single home prices on fire. In Austin, TX, for example, it is difficult to buy any homes for under $400,000, but there are plenty of rental units available, and landlords are hesitant to test the market with hefty increases.

In our view, loads of stimulus money and a quickly recovering economy equal inflation danger, and that alone will put upward pressure on one- and two-bedroom rental prices.

Be sure to check back next month to see how this plays out.

Methodology

Each month, using millions of Rentable listings across the United States, we calculate the median 1-bedroom and 2-bedroom rent prices by city, state, and nation, and track the month-over-month percent change. To avoid small sample sizes, we restrict the analysis for our reports to cities meeting minimum population and property count thresholds.

For press inquiries, please contact Sam Radbil.